By Sho Chandra, Bloomberg News–

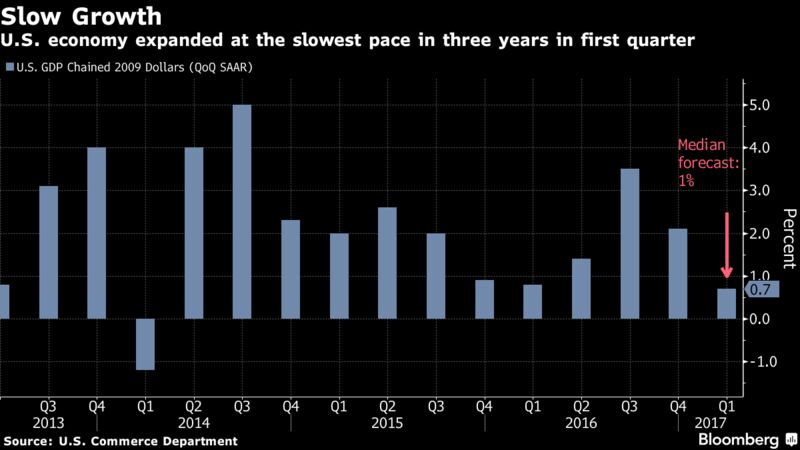

The U.S. economy expanded at the slowest pace in three years as weak auto sales and lower home-heating bills dragged down consumer spending, offsetting a pickup in investment led by housing and oil drilling.

Gross domestic product, the value of all goods and services produced, rose at a 0.7 percent annualized rate after advancing 2.1 percent in the prior quarter, Commerce Department data showed Friday in Washington. The median forecast of economists surveyed by Bloomberg called for a 1 percent gain. Consumer spending, the biggest part of the economy, rose 0.3 percent, the worst performance since 2009.

The GDP slowdown owes partly to transitory forces such as warm weather and volatility in inventories, which supports forecasts for a rebound as high confidence among companies and consumers and a solid job market underpin growth. Even so, the weakness at car dealers could weigh on expansion, and further gains in business investment could depend on the extent of policy support such as tax cuts.

“There’s no cause for concern,” said Ryan Sweet, an economist at Moody’s Analytics Inc. in West Chester, Pennsylvania, citing seasonal-adjustment issues in the data and temporary factors that affected consumer spending. Business investment is “encouraging,” while consumers “had a little bit of a hangover, and they’ll bounce back in second quarter. The key will be wage gains — we need strong wage-growth support for spending going forward.”

The data are unlikely to dissuade Federal Reserve policy makers from raising interest rates in the coming months. Economists were largely expecting a weak growth figure, calling it a blip and not a sign of stagnation.

Analysts have pointed to issues with the Commerce Department’s seasonal adjustment of growth data: Since 2000, expansion in the first quarter of each year has averaged 1 percent, compared with 2.2 percent for the rest of each year, according to Wells Fargo Securities.

Trump’s Target

Though the first-quarter figure isn’t a verdict on President Donald Trump’s policies, economists are generally skeptical that growth will reach his goal of 3 percent to 4 percent on a sustained basis. Analysts’ estimates indicate just 2.2 percent to 2.3 percent annual growth through 2019, a tad above the average pace during the almost eight-year expansion.

During the first quarter, a chief driver of growth was private, fixed nonresidential investment, which contributed 1.12 percentage point to expansion, led by a record increase in mining exploration, shafts and wells, a category that includes oil structures. Residential investment added 0.5 point to growth.

The change in inventories, one of the most volatile parts of the GDP calculation, subtracted 0.93 percentage point from growth, following a 1.01 percent gain. Trade, also volatile from quarter to quarter, contributed 0.07 point after a 1.82 point drag in the previous period.

Economists’ forecasts for overall growth ranged from zero to 2.2 percent. The GDP estimate is the first of three for the quarter, with the other releases scheduled for May and June when more information becomes available.

The 0.3 percent growth in household consumption, which accounts for about 70 percent of the economy, followed a 3.5 percent jump from October to December. The median forecast in the Bloomberg survey called for 0.9 percent, and purchases added 0.23 percentage point to first-quarter growth.

While some of the slowdown may be temporary, inflation is eating into consumers’ wallets. Real disposable personal income rose at a 1 percent pace in the period, the weakest since the fourth quarter of 2013. Even though hiring has been humming along and the jobless rate of 4.5 percent is the lowest in almost a decade, a sustained pickup in wage growth would help boost consumers’ ability to spend.

Business Investment

Nonresidential fixed investment, or spending on equipment, structures and intellectual property, increased at a 9.4 percent annualized pace, the fastest since 2013. It grew at a 0.9 percent rate in the previous quarter.

Among the details, equipment spending advanced 9.1 percent, a two-year high, while investment in nonresidential structures, including office buildings and factories, surged 22.1 percent after dropping 1.9 percent in the prior quarter.

Residential spending increased at a 13.7 percent annualized rate, the most since the second quarter of 2015, compared with the prior quarter’s advance of 9.6 percent.

Trade added slightly to growth, as exports increased by more than imports during the quarter.

Final sales to private domestic purchasers — which strip out government agencies, inventories and trade — rose at a 2.2 percent pace after a 3.4 percent advance.

Government spending fared worse, decreasing 1.7 percent and taking away 0.3 percentage point from growth. State and local outlays fell at a 1.6 percent annualized rate, while spending by federal agencies dropped at a 1.9 percent pace.

The report also showed price pressures were picking up. The GDP price index rose 2.3 percent in the first quarter. A measure of inflation tied to consumer spending and excluding volatile food and energy costs was up 2 percent, the fastest in four quarters.

Leave A Comment

You must be logged in to post a comment.