By Sweta Singh, Reuters–

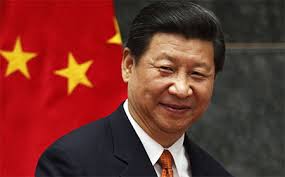

Wall Street was set to open higher on Tuesday after Chinese President Xi Jinping promised to cut import tariffs, soothing investor concerns about rising U.S.-China trade tensions.

In his first public comments since the trade dispute with the Trump administration started, Jinping vowed to open the country’s economy and said China would raise the foreign ownership limit in automobile, shipbuilding and aircraft sectors “as soon as possible”.

His comments buoyed global markets, which have been under pressure as China and the United States threatened each other with billion in tariffs and investors feared that protectionist measures would hit global economic growth.

Energy stocks gained as oil broke above $70 a barrel on easing trade war fears between the world’s two largest economies.

“The expectation was this could have gone one of two ways: he could have been aggressive about U.S. tariffs or been conciliatory and it feels like he’s more conciliatory,” said Art Hogan, chief market strategist at Wunderlich Securities in New York.

Shares of major U.S. automakers such as General Motors (GM.N), Ford (F.N), Fiat Chrysler (FCAU.N) and Tesla (TSLA.O) were up between 2 percent and 4 percent premarket following Xi’s comments.

Analysts expect quarterly profits for S&P 500 companies to rise 18.5 percent from a year ago, which would be the biggest gain in seven years, according to Thomson Reuters I/B/E/S.

The so-called FANG stocks – Facebook Inc (FB.O), Amazon.com (AMZN.O), Netflix Inc (NFLX.O) and Alphabet Inc’s Google (GOOGL.O) – were up between 1.2 percent and 3 percent ahead of Facebook CEO Mark Zuckerberg’s testimony before U.S. lawmakers on Tuesday and Wednesday.

The CEO is expected to strike a conciliatory tone in an attempt to blunt possible regulatory fallout from the privacy scandal engulfing his social network.

On Monday, stocks pared gains late in the session following a report that the Federal Bureau of Investigation raided the office of President Donald Trump’s lawyer.

At 8:44 a.m. ET, Dow e-minis 1YMc1 were up 297 points, or 1.24 percent, with 90,792 contracts changing hands.

S&P 500 e-minis ESc1 were up 29.25 points, or 1.12 percent, with 307,025 contracts traded.

Nasdaq 100 e-minis NQc1 were up 89 points, or 1.37 percent, on volume of 103,947 contracts.

Among stocks, shares of Nvidia (NVDA.O) rose 4 percent premarket after Morgan Stanley raised the stock to “overweight”.

Verifone Systems (PAY.N) shares, which were the most traded premarket, rose 53 percent after the company agreed to be taken private for $2.28 billion.

Reporting by Sweta Singh in Bengaluru; Editing by Arun Koyyur

Leave A Comment

You must be logged in to post a comment.