The Great Recession of 2008-2009 had dramatic and serious consequences for the nation. Washington reacted by passing Dodd–Frank Wall Street Reform and Consumer Protection Act, which enacted the most sweeping fundamental financial reforms since the Great Depression of the 1930’s.

Unfortunately it had unintended consequence by saddling small regional banks with extra burdensome regulations and compliance in order to protect against another financial meltdown.

Small regional banks weren’t the ones that got the nation into the financial mess from which it found itself in; it was the large banks that were the main driver of the bank crisis.

Washington has failed to understand the role in which small regional banks play in the U.S. economy.

American Enterprise Institute reported, community banks play a vital role in this nation’s economy, particularly with respect to small businesses and rural communities, and their continued health and vitality is central to the nation’s economic recovery. Community banks provide 48.1 percent of small-business loans issued by US banks, 15.7 percent of residential mortgage lending, 43.8 percent of farmland lending, 42.8 percent of farm lending, and 34.7 percent of commercial real estate loans, and they held 20 percent of all retail deposits at US banks as of 2010.

Continuing in their reporting, community banks were not responsible for the causes of the financial crisis determined by the authors of Dodd-Frank. Community banks did not engage in widespread subprime lending.

They did not engage in securitization of subprime residential mortgages. Nor did they use derivatives to engage in risky speculation to maximize return. Community banks simply did not contribute to the financial crisis.

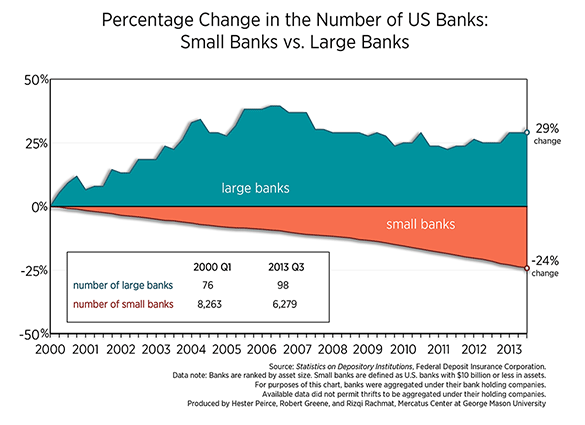

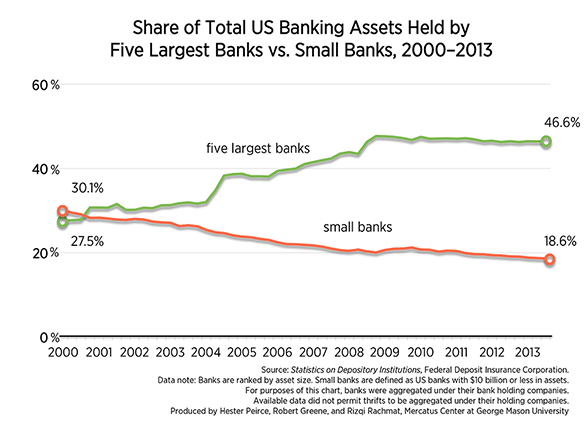

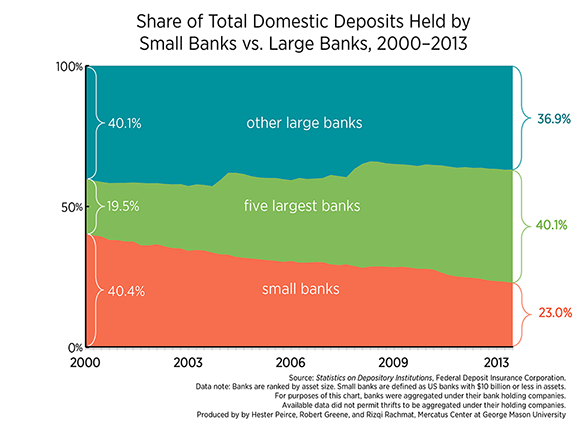

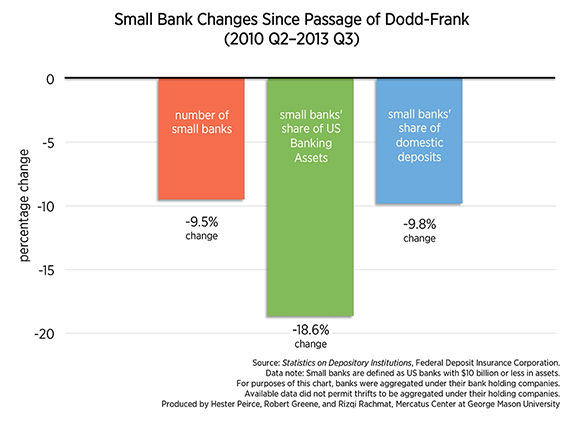

The Mercatus Center, a market-oriented think tank issued a report in February of this year, the charts below show that both the number of US small banks (which we define as banks with $10 billion or less in assets) and their share of US banking assets and domestic deposits declined substantially between 2000 and 2008.

Simultaneously, the five largest US banks’ share of US banking assets and domestic deposits increased markedly, since the financial crisis, US banking assets and deposits have continued to consolidate in a handful of large banks.

Senator Jerry Moran (R., Kan.), in a column last year highlighted this problem, “As community banks abandon their traditional business models and redirect resources to comply with Dodd-Frank, millions of Americans will have a tougher time accessing financial services and credit. In Kansas, that means fewer loans to small businesses that want to expand and fewer loans to farmers and ranchers who need to fund operations through harvest.

Continuing, “If community banks continue to go out of business or are forced to consolidate, we can expect to see even greater concentration of assets among the “too big to fail” institutions — and a greater number of Americans without a local bank.”

Richard Fisher, president of the Dallas Federal Reserve, issued this stunning pronouncement, “Today, we have about 5,500 banking organizations in the United States. Nearly each and every one of these bank holding companies represents no threat to the survival of our economic system.”

Fisher continued, “But less than one dozen of the largest and most complex banks are each capable, through a series of missteps by their management, of seriously damaging the vitality, resilience, and prosperity that has personified the U.S. economy,” he said. Fischer left with this dire message: “Any of these megabanks, given their systemic economic footprint and interconnectedness with other large financial institutions, could threaten to bring down the economy again.”

It’s time to re-examine the effects of financial reform on the small regional banking sector. It will need comprehensive bi-partisan cooperation, unlike what happened the last time when Dodd-Frank passed on strictly a partisan vote.

Both Republicans and Democrats will blame the other side but both are responsible for the demise of the small regional banks.

… [Trackback]

[…] There you will find 79563 more Infos: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More here: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] There you will find 70916 more Infos: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Informations on that Topic: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More here: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More here: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] There you will find 80997 more Infos: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More here: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Informations on that Topic: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More here: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Informations on that Topic: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] There you will find 38891 more Infos: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Informations on that Topic: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More Infos here: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More Infos here: ubaldireports.com/decline-small-banks-financial-reform/ […]

… [Trackback]

[…] Read More: ubaldireports.com/decline-small-banks-financial-reform/ […]

wyroby szklane piotrków trybunalski

ZakÅad szklarski oferuje szkÅo i wyroby szklane.Szklarz w Piotrków gwarantuje profesjonale usÅugi szklarskie w przystÄpnych cenach.

szyby zespolone piotrków

ZakÅad szklarski oferuje szkÅo i wyroby szklane,szyby zespolone.Szklarz w Åódź gwarantuje profesjonale usÅugi szklarskie w atrakcyjnych cenach.