By Fred Imbert, CNBC–

U.S. stock futures rose on Monday even as U.S. coronavirus cases continued to surge.

The Dow Jones Industrial Average futures climbed about 0.4%. The move implied an opening gain of about 150 points. S&P 500 futures added 0.2%. Nasdaq-100 futures were lower.

Shares of Dow-member Boeing added 3% in premarket trading as Reuters reported certification flights for the Boeing 737 Max were set to begin Monday.

Investors bet on select stocks on hopes most state economies will continue to reopen even as some hotspots pop up. Southwest Airlines jumped after Goldman Sachs upgraded the shares to buy from sell. Southwest added 1.7% in premarket trading. Shares of retailer Gap and casino MGM Resorts also gained in the premarket.

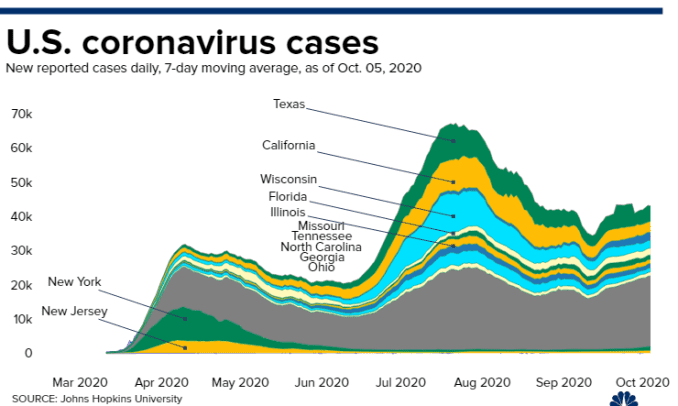

Data compiled by Johns Hopkins University showed more than 2.5 million cases have been confirmed across the U.S. On Friday alone, there were 45,255 additional cases were reported, bringing the country’s seven-day average to more than 41% from the prior week.

On Saturday, Florida reported a one-day record of cases of 9,636. The state reported an additional 8,577 on Sunday. Those figures were released after Florida once again banned drinking at bars on Friday. Texas — another state that has seen record spikes in coronavirus infections — rolled back on Friday some of its reopening measures. Arizona Gov. Doug Ducey said Friday cases in the state are “growing fast across all age groups and demographics.”

Health and Human Services Secretary Alex Azar warned on Sunday that the “window is closing” for the U.S. to curb the coronavirus outbreak.

He also noted the S&P 500 closed below its 200-day moving average — a level closely watched by traders — as Wall Street “paused to assess not only the near-term implications of these risks.”

The major averages posted their second weekly declines in three weeks. The Dow dropped 3.3% last week while the S&P 500 lost 2.9%. The Nasdaq Composite fell 1.9% last week. On Friday, the Dow dropped more than 700 points while the S&P 500 and Nasdaq each fell over 2.4%.

“The bearish argument for the current market is breadth has not strengthened during this period of consolidation,” said Andrew Thrasher, founder of Thrasher Analytics, in a note. “That’s discouraging as more stocks have broken down along with the index.”

Thrasher noted 3,150 will be a key level to watch for investors. “I’m less interested in risky assets until we get back to that level,” he said.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Leave A Comment

You must be logged in to post a comment.